Are you tired of being denied loans, credit cards, or even rental applications due to your low credit score? Don’t worry, you’re not alone. Many people struggle with maintaining a good credit score, but the good news is that there are steps you can take to improve it. In this article, we will explore three effective strategies that can help you boost your credit score and regain financial freedom.

From paying your bills on time to reducing your credit card balances, these methods are proven to make a significant impact on your creditworthiness. So, whether you’re looking to get a better interest rate on a mortgage or simply want to have more financial options available to you, keep reading to discover the secrets to improving your credit score. Don’t let a poor credit score hold you back any longer – it’s time to take control of your financial future!

UNDERSTANDING CREDIT SCORES

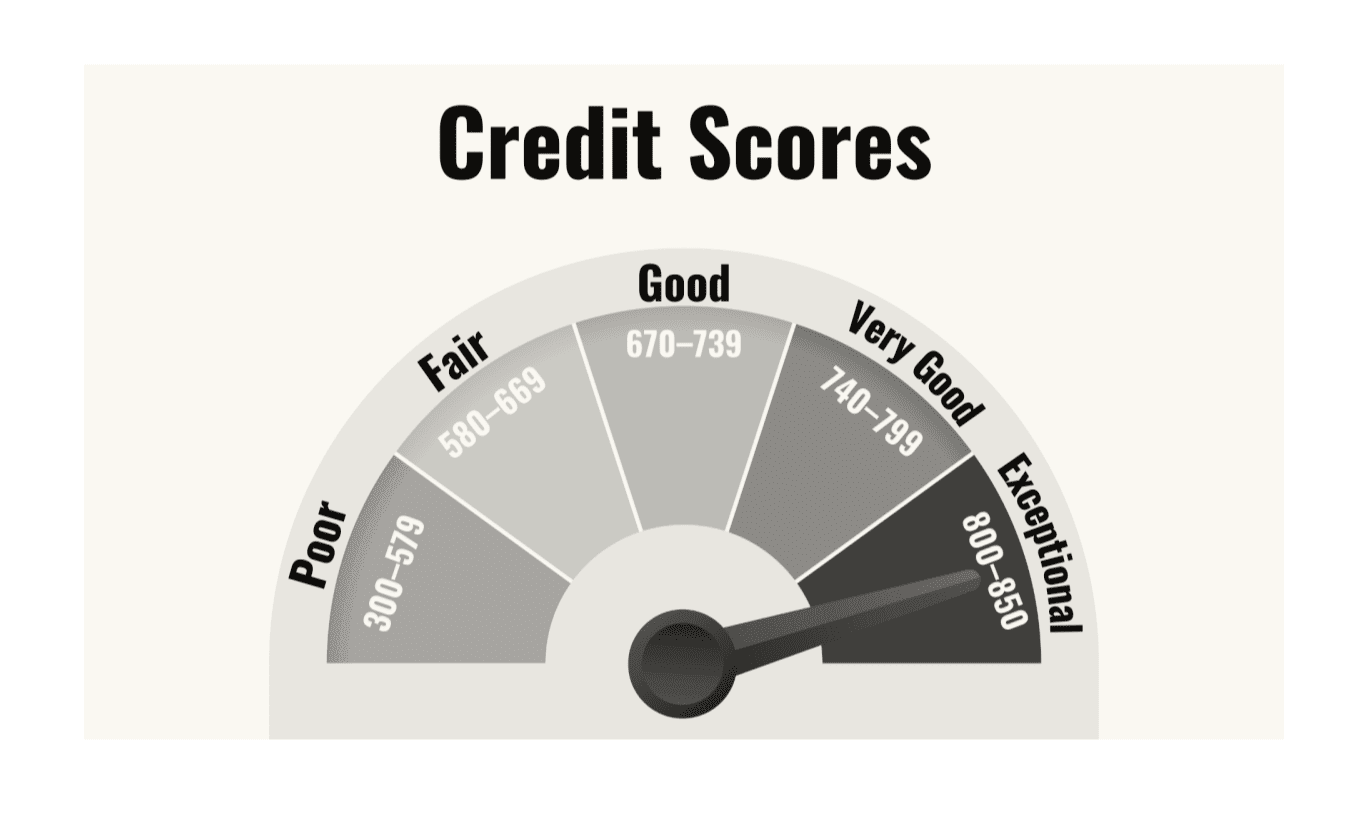

Before we delve into the strategies for improving your credit score, it’s essential to understand what a credit score is and how it is calculated. Your credit score is a three-digit number that represents your creditworthiness. It is used by lenders, landlords, and even potential employers to assess your financial responsibility and determine whether you are a reliable borrower. The higher your credit score, the more likely you are to be approved for loans and credit cards with favorable terms.

Your score is calculated based on various factors, including your payment history, credit utilization, length of credit history, credit mix, and new credit inquiries. Each of these factors carries a different weight in determining your overall credit score. By understanding these factors, you can take targeted actions to improve your creditworthiness and boost your credit score.

IMPORTANCE OF A GOOD CREDIT SCORE

Having a good credit score is crucial for several reasons. Firstly, it opens up a world of financial opportunities. With a higher score, you are more likely to be approved for loans, credit cards, and even rental applications. This means you can access better interest rates and more favorable terms, saving you money in the long run.

Secondly, a good score can positively impact your personal and professional life. Landlords often check credit scores when considering rental applications, and employers may review credit history as part of the hiring process. A higher credit score reflects your financial responsibility and can give you an edge over other applicants.

Lastly, a good score provides peace of mind. Knowing that you have a solid credit history and a high credit score can alleviate financial stress and give you confidence in your ability to manage your finances effectively.

FACTORS THAT AFFECT CREDIT SCORES

To effectively improve your credit score, it’s essential to understand the factors that impact it. Let’s take a closer look at each of these factors:

PAYMENT HISTORY

Your payment history is the most critical factor in determining your credit score. It accounts for about 35% of your overall score. Lenders want to see that you consistently make your payments on time. Late payments, missed payments, or defaults can significantly lower your credit score.

CREDIT UTILIZATION

Credit utilization refers to the percentage of your available credit that you are currently using. It accounts for approximately 30% of your total score. To improve your credit score, aim to keep your credit card balances low. Ideally, you should aim to use no more than 30% of your available credit.

NEW CREDIT INQUIRIES

When you apply for new credit, such as a loan or credit card, a hard inquiry is placed on your credit report. Too many hard inquiries within a short period can lower your credit score. Aim to limit new credit applications unless necessary.

By understanding these factors, you can make informed decisions and take targeted actions to improve your credit score.

3 WAYS TO IMPROVE YOUR CREDIT SCORE

Now that we have a solid understanding of credit scores and the factors that affect them, let’s explore three effective strategies to improve your credit score:

PAYING BILLS ON TIME

Paying your bills on time is one of the most crucial steps you can take to improve your credit score. Your payment history carries significant weight in determining your creditworthiness. Late payments, missed payments, or defaults can have a severe negative impact on your credit score.

To ensure timely payments, consider setting up automatic payments or reminders. This way, you won’t have to worry about forgetting to pay your bills. Additionally, creating a budget and prioritizing your bills can help you stay on top of your financial obligations. Making consistent, on-time payments will gradually improve your credit score over time.

KEEPING CREDIT CARD BALANCES LOW

Credit utilization is another essential factor in determining your credit score. Aim to keep your credit card balances low, ideally below 30% of your available credit. High credit card balances can indicate financial instability and may negatively impact your creditworthiness.

To manage your credit card balances effectively, consider paying more than the minimum payment each month. By paying more, you can reduce your balances faster and improve your credit utilization ratio. If you have multiple credit cards with balances, focus on paying off the card with the highest interest rate first.

BUILDING A POSITIVE CREDIT HISTORY

Apply for a secured credit card: A secured credit card requires a cash deposit as collateral, making it easier to get approved. By using a secured credit card responsibly and making on-time payments, you can build a positive credit history.

Become an authorized user: If you have a trusted friend or family member with a good credit history, ask them to add you as an authorized user on their credit card. Their positive credit history will be reflected on your credit report, helping you establish your own credit history.

Take out a small loan: If you can afford it, taking out a small loan and making regular payments can demonstrate your ability to manage credit responsibly.

Building a positive credit history takes time and patience, but it can significantly improve your creditworthiness and boost your credit score.

MONITORING YOUR CREDIT SCORE

Once you have implemented the strategies mentioned above, it’s crucial to monitor your credit score regularly. By keeping an eye on your credit score, you can track your progress and identify any potential issues or errors that may be negatively impacting your creditworthiness.

There are several ways to monitor your credit score:

FREE CREDIT REPORTS

You are entitled to a free credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) once a year. Reviewing these reports can help you identify any errors or discrepancies that need to be addressed.

CREDIT MONITORING SERVICES

There are various credit monitoring services available that provide real-time updates on your credit score and report. These services can alert you to any significant changes or suspicious activity, allowing you to take immediate action if necessary.

By monitoring your credit score, you can stay informed and take proactive steps to maintain or improve it.

COMMON MISCONCEPTIONS ABOUT CREDIT SCORES

There are several common misconceptions surrounding credit scores. Let’s debunk a few of them:

CLOSING UNUSED CREDIT CARDS IMPROVES YOUR CREDIT SCORE

Closing unused credit cards can actually harm your credit score. It reduces your available credit, which can negatively impact your credit utilization ratio. Instead, consider keeping the cards open and using them occasionally to keep them active.

CHECKING YOUR OWN CREDIT SCORE LOWERS IT

Checking your own credit score is considered a “soft inquiry” and does not impact your credit score. It is essential to regularly monitor your credit score to stay informed and take action if needed.

A BAD CREDIT HISTORY WILL HAUNT YOU FOREVER

While negative information can stay on your credit report for up to seven to ten years, its impact on your credit score lessens over time. By implementing the strategies mentioned earlier and practicing responsible financial habits, you can gradually improve your credit score.

BRESCIA GROUP CAN HELP IMPROVE YOUR CREDIT SCORE

If you are overwhelmed or unsure about how to improve your credit score, consider seeking professional help from us. As your real estate partner, we can help connect you with experts in the credit industry to help you develop a plan to improve your credit score.

Improving your credit score may seem like a daunting task, but with the right strategies and a commitment to responsible financial habits, it is entirely achievable. By paying your bills on time, keeping credit card balances low, and building a positive credit history, you can significantly improve your creditworthiness and open up a world of financial opportunities.

Remember, improving your credit score takes time, so be patient with the process. Regularly monitor your credit score, stay informed about your credit history, and seek professional help if needed. By taking control of your financial future and improving your credit score, you can pave the way for a brighter and more secure financial life. So, start implementing these strategies today and watch as your credit score soars to new heights. Your financial freedom awaits!